Capital Asset Pricing Model (CAPM)

CAPM is one of the most commonly used formula in finance, which describes the relationship betwwen systematic risk and expected return for assets, particularly stocks. The model is based on the relationship between an asset’s beta, the risk-free rate (typically the Treasury bill rate) and the equity risk premium.

The CAPM formula is as below:

$$r_i = r_f + \beta_i(r_m - r_f)$$

Where:

- $r_i$ is the expected return of a security

- $r_f$ is the risk free rate

- $\beta_i$ is the beta of the security relative to the market

- $r_m$ is the market return which includes all securities in the market. A good representation of the U.S. market portfolio is the S&P 500.

The goal of the CAPM formula is to gauge whether the current price of a stock is consistent with its likely return.

The beta is a measure of how much risk the investment will add to a portfolio that looks like the market, or a measure of a portfolio’s volatility in relation to the overall market. If beta is less than 1, it indicates the portforlio is less volatile than the market, which means it reduces the risk of a portfolio. On the other hand, if a portforlio is riskier than the market, it will have a betwa greater than 1.

Load the list of S&P 500 companies from Wikepedia

S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

# Get the list of S&P 500 stocks from Wikepedia

import pandas as pd

def load_data(url):

html = pd.read_html(url, header=0)

return html

# Load the list of S&P 500 companies

url = 'https://en.wikipedia.org/wiki/List_of_S%26P_500_companies'

df = load_data(url)[0]

df.head()| Symbol | Security | GICS Sector | GICS Sub-Industry | Headquarters Location | Date added | CIK | Founded | |

|---|---|---|---|---|---|---|---|---|

| 0 | MMM | 3M | Industrials | Industrial Conglomerates | Saint Paul, Minnesota | 1957-03-04 | 66740 | 1902 |

| 1 | AOS | A. O. Smith | Industrials | Building Products | Milwaukee, Wisconsin | 2017-07-26 | 91142 | 1916 |

| 2 | ABT | Abbott | Health Care | Health Care Equipment | North Chicago, Illinois | 1957-03-04 | 1800 | 1888 |

| 3 | ABBV | AbbVie | Health Care | Biotechnology | North Chicago, Illinois | 2012-12-31 | 1551152 | 2013 (1888) |

| 4 | ACN | Accenture | Information Technology | IT Consulting & Other Services | Dublin, Ireland | 2011-07-06 | 1467373 | 1989 |

Retrieve the latest stock price using yfinance

We retrieve the latest year’s stock price using yfinance.

import warnings

warnings.filterwarnings('ignore')

import yfinance as yf

data = yf.download(

# tickers list

tickers = list(df['Symbol']) + ['^GSPC'],

# valid periods: 1d, 5d, 1mo, 3mo, 6mo, 1y, 5y, 10y, ytd, max

period = '1y',

# valid intervals: 1m, 2m, 5m, 15m, 15m, 30m, 60m, 90m, 1h, 1d, 5d, 1wk, 1mo, 3mo

interval = '1d',

# group by ticker

group_by = 'ticker',

# adjust all OHLC automatically

auto_adjust = True,

# download pre/post regular market hours data

prepost = True,

# use threads for mass downloading

threads = True,

# proxy URL scheme when downloading

proxy = None

)[*********************100%%**********************] 504 of 504 completed

2 Failed downloads:

['BF.B']: Exception('%ticker%: No price data found, symbol may be delisted (period=1y)')

['BRK.B']: Exception('%ticker%: No data found, symbol may be delisted')

data['^GSPC'].head()| Price | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| Date | |||||

| 2023-02-27 | 3992.360107 | 4018.050049 | 3973.550049 | 3982.239990 | 3836950000 |

| 2023-02-28 | 3977.189941 | 3997.500000 | 3968.979980 | 3970.149902 | 5043400000 |

| 2023-03-01 | 3963.340088 | 3971.729980 | 3939.050049 | 3951.389893 | 4249480000 |

| 2023-03-02 | 3938.679932 | 3990.840088 | 3928.159912 | 3981.350098 | 4244900000 |

| 2023-03-03 | 3998.020020 | 4048.290039 | 3995.169922 | 4045.639893 | 4084730000 |

# Get the available tickers

tickers_unavailable = ['BF.B', 'BRK.B']

tickers = [ticker for ticker in list(df['Symbol']) + ['^GSPC'] if ticker not in tickers_unavailable]

print('Number of available tickers: ', len(tickers))Number of available tickers: 502

# Use Close as the price for each stock and create a new dataframe to store this data.

import numpy as np

stock = pd.DataFrame(columns = ['Date'], data = data['MMM'].index)

for i in range(0,len(tickers)):

ticker = tickers[i]

stock = stock.join(

pd.Series(

data[ticker]['Close'].to_list(),

name=ticker,

index=stock.index))

stock = stock.set_index('Date')

stock.head()| MMM | AOS | ABT | ABBV | ACN | ADBE | AMD | AES | AFL | A | ... | GWW | WYNN | XEL | XYL | YUM | ZBRA | ZBH | ZION | ZTS | ^GSPC | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||||||||||

| 2023-02-27 | 101.759285 | 64.206650 | 97.783730 | 148.282318 | 262.200623 | 322.320007 | 78.769997 | 23.996420 | 66.643791 | 141.154373 | ... | 668.472412 | 104.074387 | 63.236515 | 101.250412 | 124.182861 | 296.230011 | 122.350578 | 47.859604 | 163.987595 | 3982.239990 |

| 2023-02-28 | 101.261154 | 64.511368 | 99.694916 | 147.917068 | 261.511230 | 323.950012 | 78.580002 | 23.803526 | 66.565651 | 140.945908 | ... | 661.946350 | 107.271660 | 62.433975 | 101.349144 | 124.761726 | 300.250000 | 122.916191 | 48.078060 | 165.503891 | 3970.149902 |

| 2023-03-01 | 103.582634 | 65.631935 | 98.822639 | 149.233841 | 259.581085 | 323.380005 | 78.290001 | 23.755301 | 66.536346 | 136.518066 | ... | 664.501221 | 111.082634 | 61.176975 | 99.808891 | 123.819832 | 302.339996 | 121.139977 | 47.907097 | 166.068771 | 3951.389893 |

| 2023-03-02 | 103.291267 | 66.487114 | 100.586800 | 148.378433 | 261.225677 | 333.500000 | 80.440002 | 23.764944 | 65.989365 | 140.648071 | ... | 677.860413 | 112.260574 | 62.211575 | 100.954201 | 126.253059 | 306.059998 | 122.042961 | 45.884064 | 167.069748 | 3981.350098 |

| 2023-03-03 | 104.569481 | 66.968750 | 102.370560 | 149.993103 | 265.105774 | 344.040009 | 81.519997 | 24.208611 | 66.848907 | 142.891754 | ... | 690.823425 | 114.656044 | 62.946434 | 102.603035 | 127.224380 | 309.450012 | 125.248100 | 46.757858 | 169.031982 | 4045.639893 |

5 rows × 502 columns

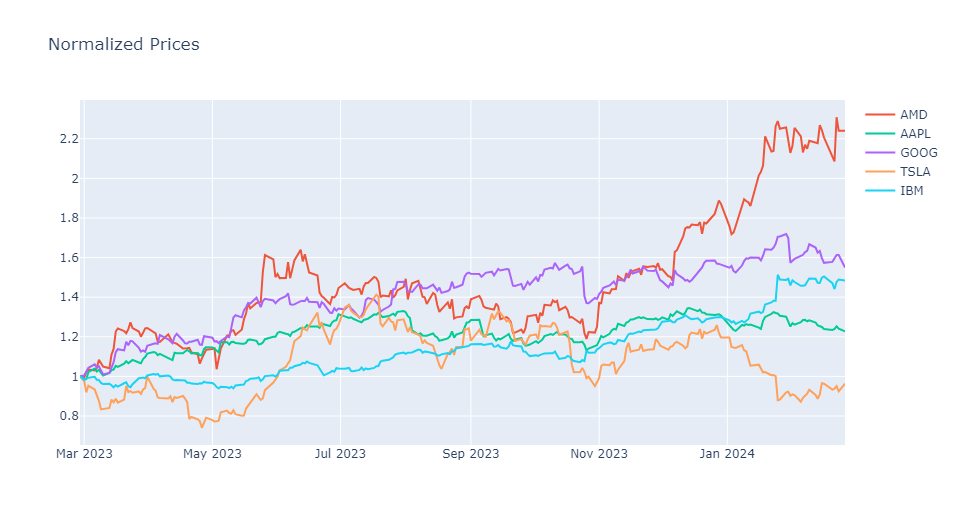

Normalize and visualize the stock data

# Normalize stock data based on initial price

def normalize(df):

x = df.copy()

for i in x.columns:

x[i] = x[i]/x[i][0]

return x

stock_normalized = normalize(stock)

stock_normalized.head()| MMM | AOS | ABT | ABBV | ACN | ADBE | AMD | AES | AFL | A | ... | GWW | WYNN | XEL | XYL | YUM | ZBRA | ZBH | ZION | ZTS | ^GSPC | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||||||||||

| 2023-02-27 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | ... | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 | 1.000000 |

| 2023-02-28 | 0.995105 | 1.004746 | 1.019545 | 0.997537 | 0.997371 | 1.005057 | 0.997588 | 0.991962 | 0.998827 | 0.998523 | ... | 0.990237 | 1.030721 | 0.987309 | 1.000975 | 1.004661 | 1.013570 | 1.004623 | 1.004565 | 1.009246 | 0.996964 |

| 2023-03-01 | 1.017918 | 1.022198 | 1.010625 | 1.006417 | 0.990009 | 1.003289 | 0.993906 | 0.989952 | 0.998388 | 0.967154 | ... | 0.994059 | 1.067339 | 0.967431 | 0.985763 | 0.997077 | 1.020626 | 0.990105 | 1.000992 | 1.012691 | 0.992253 |

| 2023-03-02 | 1.015055 | 1.035518 | 1.028666 | 1.000648 | 0.996282 | 1.034686 | 1.021201 | 0.990354 | 0.990180 | 0.996413 | ... | 1.014044 | 1.078657 | 0.983792 | 0.997074 | 1.016671 | 1.033184 | 0.997486 | 0.958722 | 1.018795 | 0.999777 |

| 2023-03-03 | 1.027616 | 1.043019 | 1.046908 | 1.011537 | 1.011080 | 1.067386 | 1.034912 | 1.008843 | 1.003078 | 1.012308 | ... | 1.033436 | 1.101674 | 0.995413 | 1.013359 | 1.024492 | 1.044627 | 1.023682 | 0.976980 | 1.030761 | 1.015921 |

5 rows × 502 columns

# Plot the normalized price of several selected stocks

import plotly.express as px

fig = px.line(title = 'Normalized Prices')

for ticker in ['AMD','AAPL','GOOG', 'TSLA','IBM']:

fig.add_scatter(x=stock_normalized.index, y=stock_normalized[ticker], name=ticker)

fig.show()

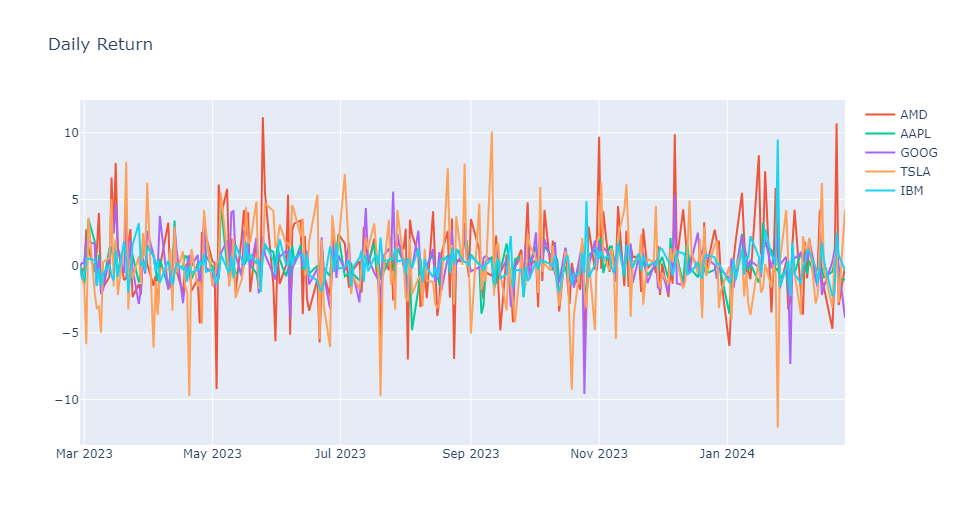

Calculate the daily return

The daily return for each stock is calculated as follows:

- Loop to each row of the stock normalized price

- Calculate the percentage change from the previous day

- The first row is set to 0 as there is no previous value

def daily_return(df):

df_daily_return = df.copy()

for i in df.columns:

for j in range(1, len(df)):

df_daily_return[i][j] = ((df[i][j]- df[i][j-1])/df[i][j-1]) * 100

df_daily_return[i][0] = 0

return df_daily_return

stock_daily_return = daily_return(stock_normalized)

stock_daily_return.head()| MMM | AOS | ABT | ABBV | ACN | ADBE | AMD | AES | AFL | A | ... | GWW | WYNN | XEL | XYL | YUM | ZBRA | ZBH | ZION | ZTS | ^GSPC | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||||||||||

| 2023-02-27 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | ... | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 2023-02-28 | -0.489519 | 0.474589 | 1.954503 | -0.246320 | -0.262925 | 0.505710 | -0.241202 | -0.803845 | -0.117251 | -0.147686 | ... | -0.976265 | 3.072104 | -1.269108 | 0.097513 | 0.466139 | 1.357050 | 0.462289 | 0.456452 | 0.924641 | -0.303600 |

| 2023-03-01 | 2.292567 | 1.737008 | -0.874946 | 0.890210 | -0.738074 | -0.175955 | -0.369052 | -0.202598 | -0.044023 | -3.141518 | ... | 0.385963 | 3.552638 | -2.013327 | -1.519749 | -0.754955 | 0.696085 | -1.445062 | -0.355595 | 0.341309 | -0.472526 |

| 2023-03-02 | -0.281289 | 1.302992 | 1.785178 | -0.573200 | 0.633556 | 3.129444 | 2.746202 | 0.040595 | -0.822080 | 3.025244 | ... | 2.010409 | 1.060418 | 1.691158 | 1.147502 | 1.965136 | 1.230403 | 0.745406 | -4.222826 | 0.602748 | 0.758219 |

| 2023-03-03 | 1.237485 | 0.724405 | 1.773354 | 1.088211 | 1.485343 | 3.160422 | 1.342608 | 1.866895 | 1.302548 | 1.595246 | ... | 1.912342 | 2.133848 | 1.181226 | 1.633250 | 0.769345 | 1.107631 | 2.626238 | 1.904353 | 1.174500 | 1.614774 |

5 rows × 502 columns

# Plot the daily return for the selected stocks

fig = px.line(title = 'Daily Return')

for ticker in ['AMD','AAPL','GOOG', 'TSLA','IBM']:

fig.add_scatter(x=stock_daily_return.index, y=stock_daily_return[ticker], name=ticker)

fig.show()

Calculate Beta for AAPL

Beta is the slope of the line regression line, or the market return vs. stock return, which could be calculated using np.polyfit

# S&P 500 has ticker symbol ^GSPC

beta, alpha = np.polyfit(stock_daily_return['^GSPC'], stock_daily_return['AAPL'], 1)

beta1.0716621967198638

Calculate CAPM for AAPL

# Daily return for the market

stock_daily_return['^GSPC'].mean()0.09994347738081993

# Annual return for the market would be the daily return multiply the number of trading days in a year

r_m = stock_daily_return['^GSPC'].mean() * 252

print('Return of the market: ', r_m)Return of the market: 25.185756299966624

# Expected return could be calculated using CAPM formula

# Assume the risk free rate rate is 0

r_f = 0

r_e_AAPL = r_f + beta * (r_m - r_f)

print('Expected return: ', r_e_AAPL)Expected return: 26.99062292247338

Apparently this is not realistic.

- The markets are very competitive and efficient, investors who work in the markets are rational and risk-averse. Everything can change very fast.