Sharpe Ratio

It is virtually impossible to increase return without also increasing risk, therefore it shall exist a trade-off between risk and return which encourages us to find a metric so that by using it we can maximize the return while minimize the risk.

The Sharpe Ratio, developed by Nobel Prize winner William Sharpe, helps investors evaluate the return of an investment compared to its risk relative to a risk-free asset. It has three key metrics: the annual return of the investment, the prevailing risk-free rate, and the standard deviation of the investment’s returns.

Shape Ratio = (r_portfolio - r_rf) / std_portfolio

Where:

- r_portfolio is annual return of the portfolio

- r_rf is the risk-free rate - usually the rate offered by short-term Treasury bills.

- std_portfolio is the standard deviation of the portfolio’s return.

Now is the moment to estimate the Sharpe Ratio for S&P 500 (^GSPC) by using Python.

import numpy as np

import pandas as pd

import yfinance as yfsp500 = yf.Ticker('^GSPC')

data_sp500 = sp500.history(interval='1d', start='2023-03-06', end='2024-03-06')

data_sp500.head()| Open | High | Low | Close | Volume | Dividends | Stock Splits | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2023-03-06 00:00:00-05:00 | 4055.149902 | 4078.489990 | 4044.610107 | 4048.419922 | 4000870000 | 0.0 | 0.0 |

| 2023-03-07 00:00:00-05:00 | 4048.260010 | 4050.000000 | 3980.310059 | 3986.370117 | 3922500000 | 0.0 | 0.0 |

| 2023-03-08 00:00:00-05:00 | 3987.550049 | 4000.409912 | 3969.760010 | 3992.010010 | 3535570000 | 0.0 | 0.0 |

| 2023-03-09 00:00:00-05:00 | 3998.659912 | 4017.810059 | 3908.699951 | 3918.320068 | 4445260000 | 0.0 | 0.0 |

| 2023-03-10 00:00:00-05:00 | 3912.770020 | 3934.050049 | 3846.320068 | 3861.590088 | 5518190000 | 0.0 | 0.0 |

sp500_close = data_sp500['Close']

# Daily return is estimated as the log difference from the closing price

sp500_dr = np.log(sp500_close).diff().dropna()Consdier 260 weekdays in a 52-week year, but generally markets are closed for about 8 days each year for holidays, therefore to calculate the yearly mean return we could use the average daily return to multiply 252.

sp500_meanreturn = np.mean(sp500_dr)*251

sp500_volatility = np.std(sp500_dr) * np.sqrt(251) # Calculate the Sharpe Ratio of S&P500

# risk-free rate is using short-term Threasury yields ~5% (https://www.bloomberg.com/markets/rates-bonds/government-bonds/us)

rfr = 0.05

sp500_sharpe_ratio = (sp500_meanreturn - rfr)/sp500_volatility

print('The estimated Sharpe Ratio for S&P 500 is: ', sp500_sharpe_ratio)The estimated Sharpe Ratio for S&P 500 is: 1.4460114773564745

print('S&P 500 total return is: ', sp500_close[-1]/sp500_close[0] - 1)

print('S&P 500 volatility is: ', sp500_volatility)S&P 500 total return is: 0.254477055332641

S&P 500 volatility is: 0.1222111992429432

The above result implies that to achieve 25.45% - 5% = 20.45% yearly return, the volatility would be 12.22%, this also informs that:

- Maximum gain: Volatility + Excess Return = 12.22% + 20.45% = 32.67%

- Maximum loss: -Volatility + Excess Return = -12.22% + 20.45% = 8.23%

In this case, in a year range, the excess return could be range between 8.23% to 32.67%

Sortino Ratio

When calculating Sharpe Ratio, the standard deviation is used as the volatility, while it does not differentiate upward deviations from downward deviations, and in fact we actually seek upward deviations.

The Sortino Ratio is very similar to the Sharpe Ratio, the only difference being that where the Sharpe Ratio uses all the observations for calculating the standard deviation while the Sortino Ratio only considers the downward deviations.

def sortino_ratio(series, td, rfr):

mean = series.mean() * td - rfr

std_neg = series[series<0].std() * np.sqrt(td)

return mean/std_negsp500_sortino_ratio = sortino_ratio(sp500_dr, 252, 0.05)

print('The estimated Sortino Ratio for S&P 500 is: ', sp500_sortino_ratio)The estimated Sortino Ratio for S&P 500 is: 2.318163296302093

Calmar Ratio

Before talking about the Carmar Ratio, we need to understand the Max Drawdown, which quantifies the steepest decline from peak to trough observed for an investment.

Max Drawdown is useful as it doesn’t rely on the underlying returns being normally distributed (which is not realistic in the markets).

The Max Drawdown should be interpreted as: numbers closer to zero are preferable.

def max_drawdown(series):

compound_return = series.cumprod()

peak = compound_return.expanding(min_periods=1).max()

drawdown = compound_return/peak - 1

return drawdown.min()sp500_max_drawdown = max_drawdown(sp500_dr)

print('The estimated Max Drawdown for S&P 500 is: ', sp500_max_drawdown)The estimated Max Drawdown for S&P 500 is: -1.0145839694360674

The Carmar Ratio is then calculated as the average return divided by the Max Drawdown.

def carmar_ratio(series, td):

max_dd = abs(max_drawdown(series))

return series.mean() * td / max_ddsp500_carmar_ratio = carmar_ratio(sp500_dr, 252)

print('The estimated Carmar Ratio for S&P 500 is: ', sp500_carmar_ratio)The estimated Carmar Ratio for S&P 500 is: 0.22435014327283942

Omega Ratio

The Sharpe Ratio and Sortino Ratio works well if the return is in normal distribution, while this is not realistic in the markets. The Sharpe Ratio could hide some important information about the patterns of the returns, for example two different return distributions could have the same mean and standard deviation, but differ significantly in other aspects.

Omega Ratio is the probability-weighted ratio of gains over losses at a given level of expected return (known as threshold). It does this by adding up the area under the distribution around the threshold, the area above the threshold measures the weight of the gains, while the area below the threshold measures the weight of the losses. The Omega Ratio is the positive area divided by the negative area.

def omega_ratio(series, td, threshold):

# calculate daily threshold

dailyThreshold = (threshold+1)**np.sqrt(1/td)-1

# calculate the excess return

excess_return = series - dailyThreshold

# get sum of all values excess return above 0

positiveSum = sum(excess_return[excess_return > 0])

# get sum of all values excess return below 0

negativeSum = sum(excess_return[excess_return < 0])

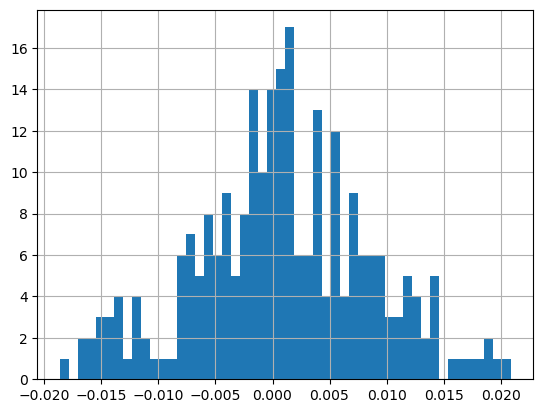

return positiveSum/(-negativeSum) sp500_dr.hist(bins=50)<Axes: >

sp500_omega_ratio = omega_ratio(sp500_dr, 252, 0.005)

print('The estimated Omega Ratio with threshold 0.5% for S&P 500 is: ', sp500_omega_ratio)The estimated Omega Ratio with threshold 0.5% for S&P 500 is: 1.2180141953898103

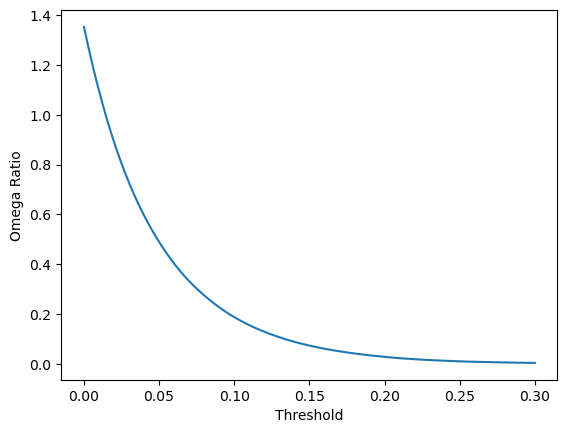

It has better view to plot the Omega Ratio curve with changing thresholds.

import matplotlib.pyplot as plt

omega_ratios = []

thresholds = np.linspace(0,0.3,100)

for t in thresholds:

val = round(omega_ratio(sp500_dr, 252, t), 10)

omega_ratios.append(val)

plt.plot(thresholds, omega_ratios)

plt.ylabel("Omega Ratio")

plt.xlabel("Threshold")Text(0.5, 0, 'Threshold')