Background

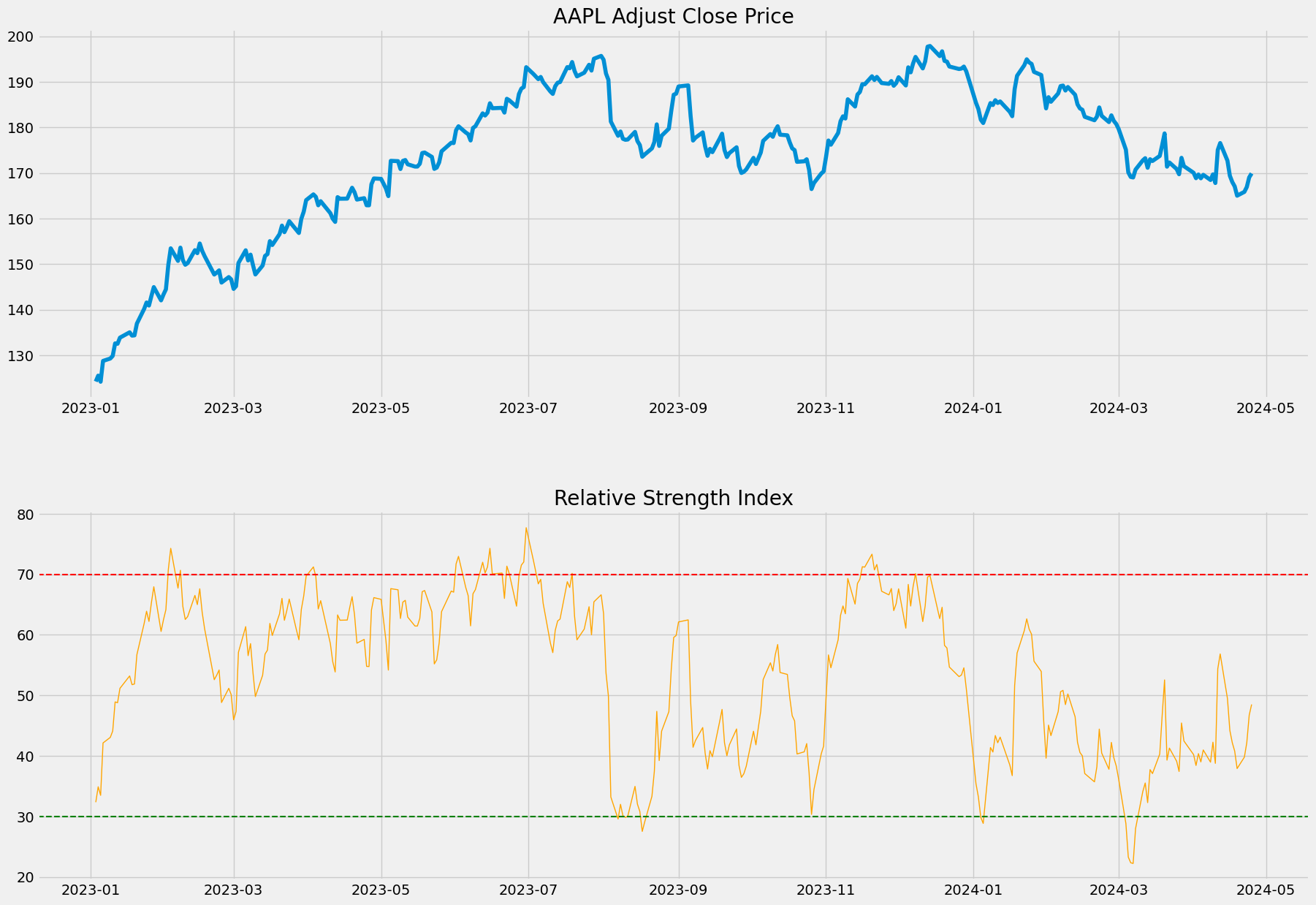

RSI is a momentum indicator that measures the speed and magnitude of a security’s recent price changes to evaluate overvalued or undervalued conditions in the price of that security. It is displayed as an oscillator (a line graph) on a scale of zero to 100.

Besides the indication of overbought and oversold securities, RSI can also point securities that may be primed for a trend reversal or corrective pullback in price. Simply speaking, it can signal when to buy and sell. Traditionally, an RSI reading of 70 or above indicates an overbought situation. A reading of 30 or below indicates an oversold condition.

Python implemenation

import pandas as pd

import sqlite3

# load S&P500 data from stored database

sp500_db = sqlite3.connect(database="sp500_data.sqlite")

df = pd.read_sql_query(sql="SELECT * FROM SP500",

con=sp500_db,

parse_dates={"Date"})

df.head()| level_0 | index | Date | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | -0.002274 | NaN |

| 1 | 1 | 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | -0.000788 | NaN |

| 2 | 2 | 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | -0.006397 | NaN |

| 3 | 3 | 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | -0.062705 | NaN |

| 4 | 4 | 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | -0.013411 | NaN |

import pandas_ta

# calculate relative strength index

df['rsi'] = df.groupby(by='Ticker')['Adj Close'].transform(lambda x: pandas_ta.rsi(close=x, length=14))

aapl = df[df['Ticker'] == 'AAPL'].set_index('Date').drop('index',axis=1)

aapl.tail()| level_0 | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2024-04-19 | 1229877 | AAPL | 165.000000 | 165.000000 | 166.399994 | 164.080002 | 166.210007 | 67772100.0 | 0.000078 | 37.902497 |

| 2024-04-22 | 1230380 | AAPL | 165.839996 | 165.839996 | 167.259995 | 164.770004 | 165.520004 | 48116400.0 | 0.000111 | 39.784337 |

| 2024-04-23 | 1230883 | AAPL | 166.899994 | 166.899994 | 167.050003 | 164.919998 | 165.350006 | 49537800.0 | 0.000049 | 42.166124 |

| 2024-04-24 | 1231386 | AAPL | 169.020004 | 169.020004 | 169.300003 | 166.210007 | 166.539993 | 48251800.0 | 0.000085 | 46.706439 |

| 2024-04-25 | 1231889 | AAPL | 169.889999 | 169.889999 | 170.610001 | 168.149994 | 169.529999 | 50558300.0 | 0.000104 | 48.493460 |

# update the database

df.drop('level_0', axis=1).to_sql(name="SP500",

con=sp500_db,

if_exists="replace",

index=True)

sp500_db.close()import matplotlib.pyplot as plt

from datetime import datetime

# only select the data from 2023-01-01

aapl_new = aapl[aapl.index > datetime(2023,1,1)]

# set the theme of the chart

plt.style.use('fivethirtyeight')

plt.rcParams['figure.figsize'] = (20,16)

# create two charts on the same figure

ax1 = plt.subplot2grid((10,1),(0,0), rowspan=4, colspan=1)

ax2 = plt.subplot2grid((10,1),(5,0), rowspan=4, colspan=1)

# plot the closing price on the first chart

ax1.plot(aapl_new['Adj Close'])

ax1.set_title('AAPL Adjust Close Price')

# plot the RSI on the second chart

ax2.plot(aapl_new['rsi'], color='orange', linewidth=1)

ax2.set_title('Relative Strength Index')

# add two horizontal lines, signaling the buy and sell ranges

# oversold

ax2.axhline(30, linestyle='--', linewidth=1.5, color='green')

# overbought

ax2.axhline(70, linestyle='--', linewidth=1.5, color='red')<matplotlib.lines.Line2D at 0x183fbdf2a10>

Discussion

Overbought or oversold

Generally, when the RSI indicator crosses 30 on the RSI chart (refer above), it is a bullish sign and when it crosses 70, it is a bearish sign. Therefore when the RSI values are 70 or above, it indicates the security is becoming overbought or overvalued, on the other hand, if an RSI value is 30 or below, it is interpreted that the security is oversold or undervalued.

Uptrend and downtrend

During an uptrend, the RSI tends to stay above 30 and should frequently hit 70. During a downtrend, it is rare to see the RSI exceed 70, and it frequently hits 30 or below.

Limitation

The RSI’s signals are most reliable when they conform to the long-term trend.

True reversal signals are rare and can be difficult to separate from false alarms.

The RSI is most useful in an oscillating market where the asset price is alternating between bullish and bearish movements.

Reference

Relative Strength Index (RSI) Indicator Explained With Formula by JASON FERNANDO