Background

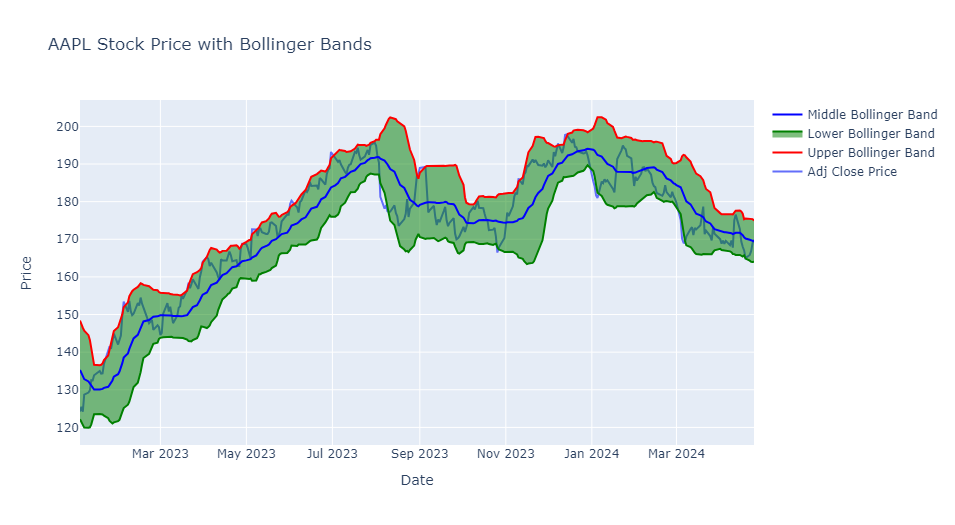

Bollinger Bands are a type of statistical chart characterizing the prices and volatility over time of an asset, using a formulaic method propounded by John Bollinger in the 1980s.

Bollinger Bands consist of an N-period moving average (MA), an upper band at K times an N-period standard deviation above the moving average (MA + Kσ), and a lower band at K times an N-period standard deviation below the moving average (MA − Kσ). Typical values for N and K are 20 days and 2, respectively.

Bollinger Bands can be used to provide a relative definition of high and low prices of a market, that is to say, prices are high at the upper band and low at the lower band. Traders often use Bollinger Bands to determine whether an asset is overbought or oversold. When prices approach the upper band, it suggests that the asset may be overbought and due for a correction, while prices near the lower band suggest that the asset may be oversold and due for a rebound.

Python Implementation

import pandas as pd

import sqlite3

# load S&P500 data from stored database

sp500_db = sqlite3.connect(database="sp500_data.sqlite")

df = pd.read_sql_query(sql="SELECT * FROM SP500",

con=sp500_db,

parse_dates={"Date"})

df.head()| level_0 | index | Date | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | -0.002274 | NaN |

| 1 | 1 | 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | -0.000788 | NaN |

| 2 | 2 | 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | -0.006397 | NaN |

| 3 | 3 | 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | -0.062705 | NaN |

| 4 | 4 | 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | -0.013411 | NaN |

import pandas_ta

import numpy as np

# calculate bollinger bands for AAPL

aapl = df[df['Ticker'] == 'AAPL'].set_index('Date').drop('index',axis=1).drop('level_0',axis=1)

aapl['bb_low'] = pandas_ta.bbands(close=aapl['Adj Close'], length=20).iloc[:,0]

aapl['bb_mid'] = pandas_ta.bbands(close=aapl['Adj Close'], length=20).iloc[:,1]

aapl['bb_high'] = pandas_ta.bbands(close=aapl['Adj Close'], length=20).iloc[:,2]

aapl.tail()| Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | bb_low | bb_mid | bb_high | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||

| 2024-04-19 | AAPL | 165.000000 | 165.000000 | 166.399994 | 164.080002 | 166.210007 | 67772100.0 | 0.000078 | 37.902497 | 164.869819 | 170.207500 | 175.545180 |

| 2024-04-22 | AAPL | 165.839996 | 165.839996 | 167.259995 | 164.770004 | 165.520004 | 48116400.0 | 0.000111 | 39.784337 | 164.314856 | 169.885500 | 175.456143 |

| 2024-04-23 | AAPL | 166.899994 | 166.899994 | 167.050003 | 164.919998 | 165.350006 | 49537800.0 | 0.000049 | 42.166124 | 163.989522 | 169.687999 | 175.386475 |

| 2024-04-24 | AAPL | 169.020004 | 169.020004 | 169.300003 | 166.210007 | 166.539993 | 48251800.0 | 0.000085 | 46.706439 | 163.947623 | 169.653499 | 175.359375 |

| 2024-04-25 | AAPL | 169.889999 | 169.889999 | 170.610001 | 168.149994 | 169.529999 | 50558300.0 | 0.000104 | 48.493460 | 164.025646 | 169.482499 | 174.939352 |

import plotly.graph_objs as go

from datetime import datetime

# only select the data from 2023-01-01

aapl_new = aapl[aapl.index > datetime(2023,1,1)]

# Create a Plotly figure

fig = go.Figure()

# Add the price chart

fig.add_trace(go.Scatter(x=aapl_new.index, y=aapl_new['Adj Close'], mode='lines', name='Adj Close Price'))

# Add the Upper Bollinger Band and shade the area

fig.add_trace(go.Scatter(x=aapl_new.index, y=aapl_new['bb_high'], mode='lines', name='Upper Bollinger Band', line=dict(color='red')))

fig.add_trace(go.Scatter(x=aapl_new.index, y=aapl_new['bb_low'], fill='tonexty', mode='lines', name='Lower Bollinger Band', line=dict(color='green')))

# Add the Middle Bollinger Band (MA)

fig.add_trace(go.Scatter(x=aapl_new.index, y=aapl_new['bb_mid'], mode='lines', name='Middle Bollinger Band', line=dict(color='blue')))

# Customize the chart layout

fig.update_layout(title='AAPL Stock Price with Bollinger Bands',

xaxis_title='Date',

yaxis_title='Price',

showlegend=True)

# Show the chart

fig.show()