Background

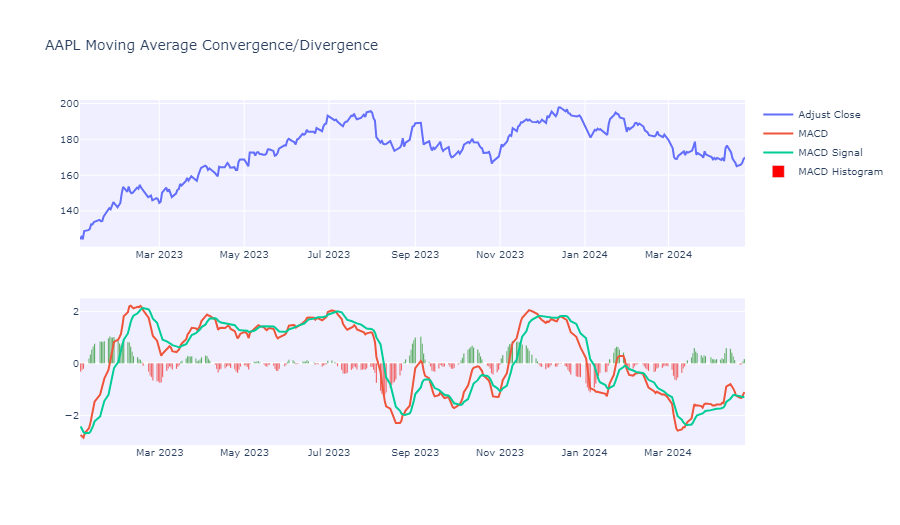

Moving average convergence/divergence (MACD) is a technical indicator to help investors identify price trends, measure trend momentum, and identify market entry points for buying and selling, it shows the relationship between two exponential moving averages (EMAs) of a security’s price.

The MACD line is calculated by subtracting the 26-period EMA from the 12-period EMA. A 9-day EMA of the MACD line is called the signal line, plotted on top of the MACD line, which can function as a trigger for buy or sell signals. When the MACD line crosses above the signal line it indicates a buy signal, when the MACD line crosses below the signal line it is the sell signal.

Python Implementation

import pandas as pd

import sqlite3

# load S&P500 data from stored database

sp500_db = sqlite3.connect(database="sp500_data.sqlite")

df = pd.read_sql_query(sql="SELECT * FROM SP500",

con=sp500_db,

parse_dates={"Date"})

df.head()| index | Date | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | -0.002274 | NaN | NaN |

| 1 | 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | -0.000788 | NaN | NaN |

| 2 | 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | -0.006397 | NaN | NaN |

| 3 | 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | -0.062705 | NaN | NaN |

| 4 | 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | -0.013411 | NaN | NaN |

# remove irrelevant columns

df = df.drop('index', axis=1)

df.head()| Date | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | -0.002274 | NaN | NaN |

| 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | -0.000788 | NaN | NaN |

| 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | -0.006397 | NaN | NaN |

| 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | -0.062705 | NaN | NaN |

| 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | -0.013411 | NaN | NaN |

# remove GEV and SOLV which were newly added (no sufficient data for MACD calculation)

df = df.drop(df[(df['Ticker'] =='GEV') | (df['Ticker'] == 'SOLV')].index)import pandas_ta

# calculate MACD

def compute_macd(close):

macd = pandas_ta.macd(close=close, length=20).iloc[:,0]

return macd.sub(macd.mean()).div(macd.std())

# calculate MACD signal

def compute_macd_signal(close):

macd_signal = pandas_ta.macd(close=close, length=20).iloc[:,2]

return macd_signal.sub(macd_signal.mean()).div(macd_signal.std())

df = df.set_index(['Date', 'Ticker'])

df['macd'] = df.groupby(level=1, group_keys=False)['Adj Close'].apply(compute_macd)

df['macd signal'] = df.groupby(level=1, group_keys=False)['Adj Close'].apply(compute_macd_signal)

df.tail()| Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | macd | macd signal | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | Ticker | |||||||||||

| 2024-04-25 | XYL | 130.610001 | 130.610001 | 131.199997 | 128.100006 | 129.619995 | 963600.0 | 0.000264 | 61.482745 | 0.665306 | 0.355146 | 0.255276 |

| YUM | 141.559998 | 141.559998 | 142.169998 | 140.389999 | 141.979996 | 1693100.0 | 0.000076 | 65.668163 | 0.322566 | 0.550830 | 0.285784 | |

| ZBH | 119.750000 | 119.750000 | 121.349998 | 118.769997 | 120.709999 | 1078800.0 | 0.000206 | 35.636078 | -0.350196 | -0.889200 | -0.646480 | |

| ZBRA | 292.529999 | 292.529999 | 293.290009 | 271.630005 | 274.359985 | 674700.0 | 0.001355 | 56.172272 | 0.500501 | -0.391439 | -0.242456 | |

| ZTS | 153.360001 | 153.360001 | 153.589996 | 150.039993 | 150.970001 | 4567200.0 | 0.000178 | 39.809619 | 1.374957 | -3.202379 | -3.584353 |

# update the database

df = df.reset_index()

df.to_sql(name="SP500",

con=sp500_db,

if_exists="replace",

index=True)

sp500_db.close()from plotly.subplots import make_subplots

import plotly.graph_objects as go

import warnings

warnings.filterwarnings('ignore')

# select AAPL

aapl = df[df['Ticker'] == 'AAPL'].set_index('Date')

# only select the data from 2023-01-01

aapl_new = aapl[aapl.index > datetime(2023,1,1)]

aapl_new['macd histogram'] = aapl_new['macd'] - aapl['macd signal']

# create a plotly figure

fig = make_subplots(rows=2, cols=1)

# adjust close

fig.add_trace(go.Scatter(x=aapl_new.index, y=aapl_new['Adj Close'], mode='lines', name='Adjust Close'), row=1, col=1)

# MACD and signal lines

fig.add_trace(go.Scatter(x=aapl_new.index, y=aapl_new['macd'], mode='lines', name='MACD'), row=2, col=1)

fig.add_trace(go.Scatter(x=aapl_new.index, y=aapl_new['macd signal'], mode='lines', name='MACD Signal'), row=2, col=1)

# histogram

fig.add_trace(go.Bar(x=aapl_new.index, y=aapl_new['macd histogram'], name='MACD Histogram',

marker_color=['green' if val >= 0 else 'red' for val in aapl_new['macd histogram']]), row=2, col=1)

# customize the chart

fig.update_xaxes(rangeslider=dict(visible=False))

fig.update_layout(plot_bgcolor='#efefff', font_size=10,width=900)

fig.update_layout(title="AAPL Moving Average Convergence/Divergence")

# show the chart

fig.show()

Reference

What is MACD? by Brian Dolan on Investopedia