Background

A moving average is used to determine the direction of a trend, it sums up the data points of a financial security over a specific time period and divides the total by the number of data points to arrive at an average, this could help to smooth out the price data by creating a constantly updated average price.

By calculating the moving average, the impacts of random, short-term fluctuations on the price of a financial security over a specified time frame are mitigated.

Simple moving averages (SMAs)

The simple moving average (SMA) is straightforward and it is obtained by summing the recent data points in a given set and dividing the total by the number of time periods.

Exponential moving averages (EMAs)

Esponential moving agerage (EMA) gives more weight to the most recent price points to make it more responsive to recent data points.

Python Implementation

import pandas as pd

import sqlite3

# load S&P500 data from stored database

sp500_db = sqlite3.connect(database="sp500_data.sqlite")

df = pd.read_sql_query(sql="SELECT * FROM SP500",

con=sp500_db,

parse_dates={"Date"})

df.head()| level_0 | index | Date | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | macd | macd signal | bb_low | bb_mid | bb_high | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | -0.002274 | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1 | 1 | 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | -0.000788 | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2 | 2 | 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | -0.006397 | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 3 | 3 | 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | -0.062705 | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 4 | 4 | 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | -0.013411 | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

# remove irrelevant columns

df = df.drop('index', axis=1)

df = df.drop('level_0', axis=1)

df.head()| Date | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | macd | macd signal | bb_low | bb_mid | bb_high | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | -0.002274 | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | -0.000788 | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | -0.006397 | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | -0.062705 | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | -0.013411 | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

import pandas_ta

df = df.set_index(['Date','Ticker'])

# compute SMA and EMA

df['sma'] = df.groupby(level=1)['Adj Close'].transform(lambda x: pandas_ta.sma(close=x,length=20))

df['ema'] = df.groupby(level=1)['Adj Close'].transform(lambda x: pandas_ta.ema(close=x,length=20))

df.tail()| Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | macd | macd signal | bb_low | bb_mid | bb_high | sma | ema | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | Ticker | ||||||||||||||||

| 2024-04-25 | XYL | 130.610001 | 130.610001 | 131.199997 | 128.100006 | 129.619995 | 963600.0 | 0.000264 | 61.482745 | 0.665306 | 0.355146 | 0.255276 | 4.845591 | 4.863502 | 4.881413 | 128.482000 | 128.582695 |

| YUM | 141.559998 | 141.559998 | 142.169998 | 140.389999 | 141.979996 | 1693100.0 | 0.000076 | 65.668163 | 0.322566 | 0.550830 | 0.285784 | 4.913482 | 4.937968 | 4.962454 | 138.497000 | 138.658563 | |

| ZBH | 119.750000 | 119.750000 | 121.349998 | 118.769997 | 120.709999 | 1078800.0 | 0.000206 | 35.636078 | -0.350196 | -0.889200 | -0.646480 | 4.772846 | 4.835888 | 4.898931 | 125.012999 | 123.565569 | |

| ZBRA | 292.529999 | 292.529999 | 293.290009 | 271.630005 | 274.359985 | 674700.0 | 0.001355 | 56.172272 | 0.500501 | -0.391439 | -0.242456 | 5.588730 | 5.666387 | 5.744044 | 288.205502 | 284.262362 | |

| ZTS | 153.360001 | 153.360001 | 153.589996 | 150.039993 | 150.970001 | 4567200.0 | 0.000178 | 39.809619 | 1.374957 | -3.202379 | -3.584353 | 4.967408 | 5.065065 | 5.162723 | 157.579352 | 157.003521 |

# update the database

df = df.reset_index()

df.to_sql(name="SP500",

con=sp500_db,

if_exists="replace",

index=True)

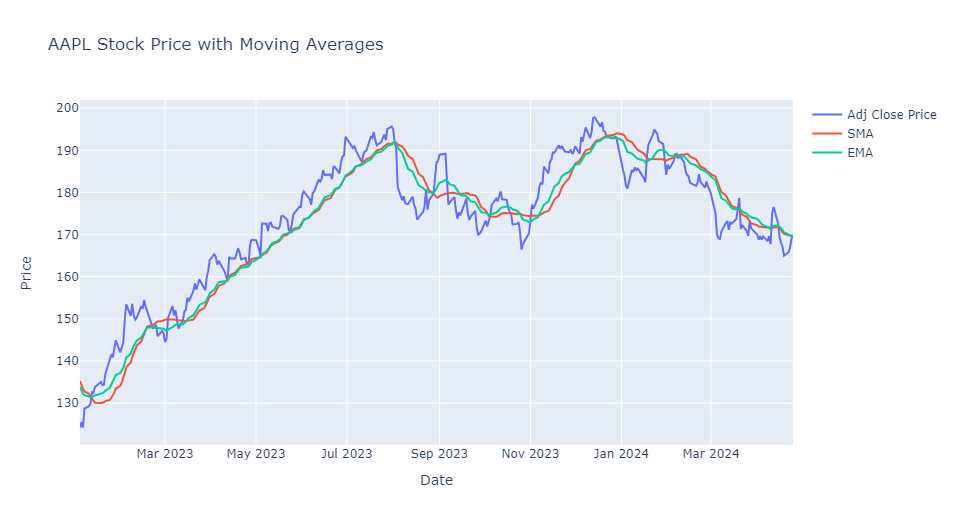

sp500_db.close()import plotly.graph_objs as go

from datetime import datetime

# select AAPL

aapl = df[df['Ticker'] == 'AAPL'].set_index('Date')

# only select the data from 2023-01-01

aapl_new = aapl[aapl.index > datetime(2023,1,1)]

# create a Plotly figure

fig = go.Figure()

# add the price chart

fig.add_trace(go.Scatter(x=aapl_new.index, y=aapl_new['Adj Close'], mode='lines', name='Adj Close Price'))

# add the SMA chart

fig.add_trace(go.Scatter(x=aapl_new.index, y=aapl_new['sma'], mode='lines', name='SMA'))

# add the EMA chart

fig.add_trace(go.Scatter(x=aapl_new.index, y=aapl_new['ema'], mode='lines', name='EMA'))

# Customize the chart layout

fig.update_layout(title='AAPL Stock Price with Moving Averages',

xaxis_title='Date',

yaxis_title='Price',

showlegend=True)

# Show the chart

fig.show()