Background

The accumulation/distribution indicator (A/D) is a cumulative indicator that uses volume and price to assess whether a stock is being accumulated or distributed. The A/D measure seeks to identify divergences between the stock price and the volume flow. It provides a measure of the commitment of bulls and bears to the market and is used to detect divergences between volume and price action - signs that a trend is weakening.

If the price is rising but the indicator is falling, then it suggests that buying or accumulation volume may not be enough to support the price rise and a price decline could be forthcoming.

The Accumulation/Distribution is calculated using the following formula: AD = AD + ((Close - Low) - (High - Close)) / (High - Low) * Volume

If a security’s price is in a downtrend while the A/D line is in an uptrend, then the indicator shows there may be buying pressure and the security’s price may reverse to the upside. Conversely, if a security’s price is in an uptrend while the A/D line is in a downtrend, then the indicator shows there may be selling pressure, or higher distribution. This warns that the price may be due for a decline.

Python Implementation

import pandas as pd

import sqlite3

# load S&P500 data from stored database

sp500_db = sqlite3.connect(database="sp500_data.sqlite")

df = pd.read_sql_query(sql="SELECT * FROM SP500",

con=sp500_db,

parse_dates={"Date"})

df.head()| index | Date | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | macd | macd signal | bb_low | bb_mid | bb_high | sma | ema | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | -0.002274 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1 | 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | -0.000788 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2 | 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | -0.006397 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 3 | 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | -0.062705 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 4 | 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | -0.013411 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

# remove irrelevant columns

df = df.drop('index', axis=1)

#df = df.drop('level_0', axis=1)

df.head()| Date | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | macd | macd signal | bb_low | bb_mid | bb_high | sma | ema | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | -0.002274 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | -0.000788 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | -0.006397 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | -0.062705 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | -0.013411 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

import pandas_ta

df = df.set_index(['Date','Ticker'])

# compute AD

def compute_ad(stock_data):

ad = pandas_ta.ad(high=stock_data['High'],

low=stock_data['Low'],

close=stock_data['Close'],

volume=stock_data['Volume'],

length=14)

return ad

df['ad'] = df_new.groupby(level=1, group_keys=False).apply(compute_ad)

df.tail()| Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | macd | macd signal | bb_low | bb_mid | bb_high | sma | ema | ad | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | Ticker | |||||||||||||||||

| 2024-04-25 | XYL | 130.610001 | 130.610001 | 131.199997 | 128.100006 | 129.619995 | 963600.0 | 0.000264 | 61.482745 | 0.665306 | 0.355146 | 0.255276 | 4.845591 | 4.863502 | 4.881413 | 128.482000 | 128.582695 | 1.381747e+08 |

| YUM | 141.559998 | 141.559998 | 142.169998 | 140.389999 | 141.979996 | 1693100.0 | 0.000076 | 65.668163 | 0.322566 | 0.550830 | 0.285784 | 4.913482 | 4.937968 | 4.962454 | 138.497000 | 138.658563 | 8.902989e+07 | |

| ZBH | 119.750000 | 119.750000 | 121.349998 | 118.769997 | 120.709999 | 1078800.0 | 0.000206 | 35.636078 | -0.350196 | -0.889200 | -0.646480 | 4.772846 | 4.835888 | 4.898931 | 125.012999 | 123.565569 | 7.870077e+07 | |

| ZBRA | 292.529999 | 292.529999 | 293.290009 | 271.630005 | 274.359985 | 674700.0 | 0.001355 | 56.172272 | 0.500501 | -0.391439 | -0.242456 | 5.588730 | 5.666387 | 5.744044 | 288.205502 | 284.262362 | 5.349014e+07 | |

| ZTS | 153.360001 | 153.360001 | 153.589996 | 150.039993 | 150.970001 | 4567200.0 | 0.000178 | 39.809619 | 1.374957 | -3.202379 | -3.584353 | 4.967408 | 5.065065 | 5.162723 | 157.579352 | 157.003521 | 2.636284e+08 |

# update the database

df = df.reset_index()

df.to_sql(name="SP500",

con=sp500_db,

if_exists="replace",

index=True)

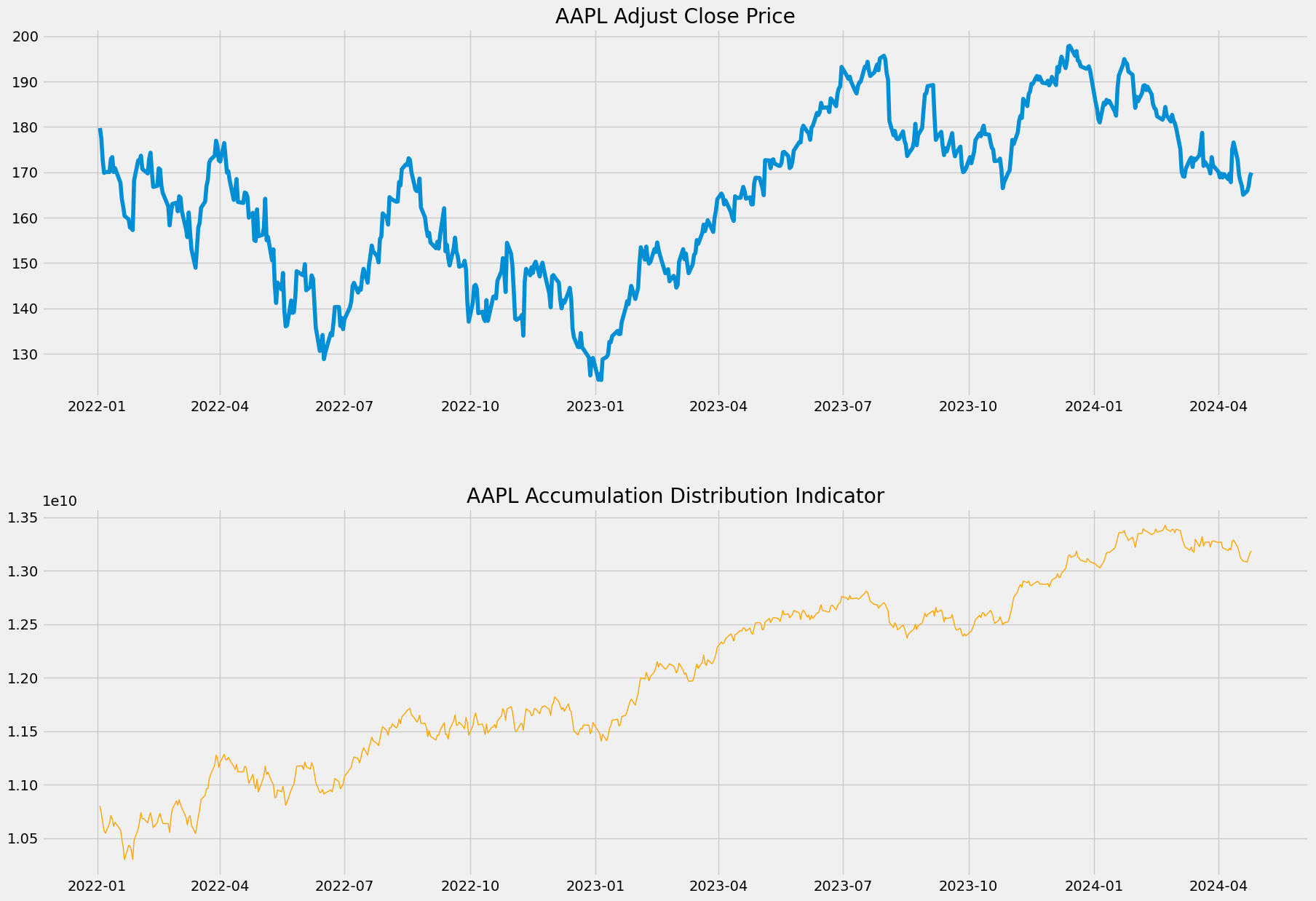

sp500_db.close()import matplotlib.pyplot as plt

from datetime import datetime

# select AAPL

aapl = df[df['Ticker'] == 'AAPL'].set_index('Date')

# only select the data from 2022-01-01

aapl_new = aapl[aapl.index > datetime(2022,1,1)]

# set the theme of the chart

plt.style.use('fivethirtyeight')

plt.rcParams['figure.figsize'] = (20,16)

# create two charts on the same figure

ax1 = plt.subplot2grid((10,1),(0,0), rowspan=4, colspan=1)

ax2 = plt.subplot2grid((10,1),(5,0), rowspan=4, colspan=1)

# plot the closing price on the first chart

ax1.plot(aapl_new['Adj Close'])

ax1.set_title('AAPL Adjust Close Price')

# plot the AD on the second chart

ax2.plot(aapl_new['ad'], color='orange', linewidth=1)

ax2.set_title('AAPL Accumulation Distribution Indicator')Text(0.5, 1.0, 'AAPL Accumulation Distribution Indicator')

Reference

Accumulation/Distribution Indicator (A/D): What it Tells You by Cory Mitchell on Investopedia

e