Background

On-balance volume is a technical analysis indicator intended to relate price and volume, and it is based on a cumulative total volume.

OBV is generally used to confirm price moves. The idea is that volume is higher on days where the price move is in the dominant direction, for example in a strong uptrend there is more volume on up days than down days.

On-balance volume is calculated by using the following formula:

Python Implementation

import pandas as pd

import sqlite3

# load S&P500 data from stored database

sp500_db = sqlite3.connect(database="sp500_data.sqlite")

df = pd.read_sql_query(sql="SELECT * FROM SP500",

con=sp500_db,

parse_dates={"Date"})

df.head()| level_0 | index | Date | Ticker | Adj Close | Close | High | Low | Open | Volume | ... | rsi | atr | macd | macd signal | bb_low | bb_mid | bb_high | sma | ema | ad | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 3.204858e+06 |

| 1 | 1 | 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 5.290623e+06 |

| 2 | 2 | 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | -4.328196e+07 |

| 3 | 3 | 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 3.273491e+06 |

| 4 | 4 | 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 9.599290e+05 |

5 rows × 21 columns

# remove irrelevant columns

df = df.drop('index', axis=1)

#df = df.drop('level_0', axis=1)

df.head()| level_0 | Date | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | macd | macd signal | bb_low | bb_mid | bb_high | sma | ema | ad | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | -0.002274 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 3.204858e+06 |

| 1 | 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | -0.000788 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 5.290623e+06 |

| 2 | 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | -0.006397 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | -4.328196e+07 |

| 3 | 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | -0.062705 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 3.273491e+06 |

| 4 | 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | -0.013411 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | 9.599290e+05 |

import pandas_ta

df = df.set_index(['Date','Ticker'])

# compute OBV

def compute_obv(stock_data):

obv = pandas_ta.obv(close=stock_data['Close'],

volume=stock_data['Volume'],

length=14)

return obv

df['obv'] = df.groupby(level=1, group_keys=False).apply(compute_obv)

df.tail()| level_0 | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | macd | macd signal | bb_low | bb_mid | bb_high | sma | ema | ad | obv | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | Ticker | |||||||||||||||||||

| 2024-04-25 | XYL | 1232347 | 130.610001 | 130.610001 | 131.199997 | 128.100006 | 129.619995 | 963600.0 | 0.000264 | 61.482745 | 0.665306 | 0.355146 | 0.255276 | 4.845591 | 4.863502 | 4.881413 | 128.482000 | 128.582695 | 1.381747e+08 | 42359600.0 |

| YUM | 1232348 | 141.559998 | 141.559998 | 142.169998 | 140.389999 | 141.979996 | 1693100.0 | 0.000076 | 65.668163 | 0.322566 | 0.550830 | 0.285784 | 4.913482 | 4.937968 | 4.962454 | 138.497000 | 138.658563 | 8.902989e+07 | 253995207.0 | |

| ZBH | 1232349 | 119.750000 | 119.750000 | 121.349998 | 118.769997 | 120.709999 | 1078800.0 | 0.000206 | 35.636078 | -0.350196 | -0.889200 | -0.646480 | 4.772846 | 4.835888 | 4.898931 | 125.012999 | 123.565569 | 7.870077e+07 | -62096220.0 | |

| ZBRA | 1232350 | 292.529999 | 292.529999 | 293.290009 | 271.630005 | 274.359985 | 674700.0 | 0.001355 | 56.172272 | 0.500501 | -0.391439 | -0.242456 | 5.588730 | 5.666387 | 5.744044 | 288.205502 | 284.262362 | 5.349014e+07 | 37474700.0 | |

| ZTS | 1232351 | 153.360001 | 153.360001 | 153.589996 | 150.039993 | 150.970001 | 4567200.0 | 0.000178 | 39.809619 | 1.374957 | -3.202379 | -3.584353 | 4.967408 | 5.065065 | 5.162723 | 157.579352 | 157.003521 | 2.636284e+08 | 255609600.0 |

# update the database

df = df.reset_index()

df.to_sql(name="SP500",

con=sp500_db,

if_exists="replace",

index=True)

sp500_db.close()import matplotlib.pyplot as plt

from datetime import datetime

# select AAPL

aapl = df[df['Ticker'] == 'AAPL'].set_index('Date')

# only select the data from 2022-01-01

aapl_new = aapl[aapl.index > datetime(2022,1,1)]

# set the theme of the chart

plt.style.use('fivethirtyeight')

plt.rcParams['figure.figsize'] = (20,16)

# create two charts on the same figure

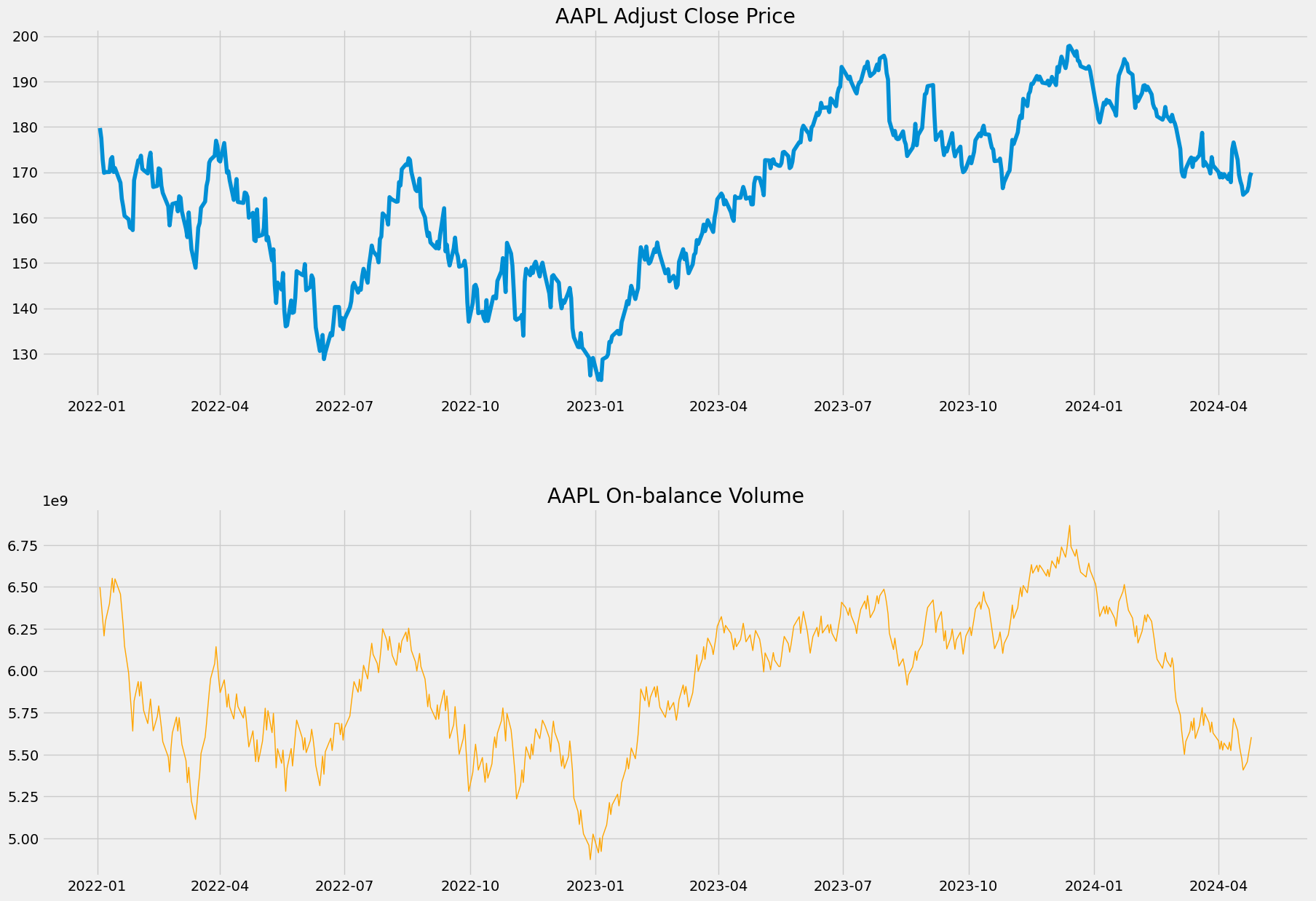

ax1 = plt.subplot2grid((10,1),(0,0), rowspan=4, colspan=1)

ax2 = plt.subplot2grid((10,1),(5,0), rowspan=4, colspan=1)

# plot the closing price on the first chart

ax1.plot(aapl_new['Adj Close'])

ax1.set_title('AAPL Adjust Close Price')

# plot the OBV on the second chart

ax2.plot(aapl_new['obv'], color='orange', linewidth=1)

ax2.set_title('AAPL On-balance Volume')Text(0.5, 1.0, 'AAPL On-balance Volume')

Reference

On-Balance Volume (OBV): Definition, Formula, and Uses As Indicator by Adam Hayes on Investopedia.