Background

The force index (FI) is a technical indicator to illustrate how strong the actual buying or selling pressure is. High positive values mean there is a strong rising trend, and low values signify a strong downward trend.

The FI is calculated by multiplying the difference between the last and previous closing prices by the volume of the security, yielding a momentum scaled by the volume. The strength of the force is determined by a larger price change or by a larger volume.

The index is an oscillator, fluctuating between positive and negative territory, therefore it is used for trend and breakout confirmation, as well as spotting potential turning points by looking for divergences.

The index is a lagging indicator whch is using prior price and volume data, and then that data is used to calculate an average (EMA), it could then sometimes be slow to provide trade signals. For example, it may take a couple of periods for the force index to start rallying after an upside breakout, but by this time the price may have already moved significantly beyond the breakout point and may thus no longer justify an entry.

Python Implementation

import pandas as pd

import sqlite3

# load S&P500 data from stored database

sp500_db = sqlite3.connect(database="sp500_data.sqlite")

df = pd.read_sql_query(sql="SELECT * FROM SP500",

con=sp500_db,

parse_dates={"Date"})

df.head()| index | Date | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | ... | macd signal | bb_low | bb_mid | bb_high | sma | ema | ad | obv | emv | efi | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | -0.002274 | ... | NaN | NaN | NaN | NaN | NaN | NaN | 3.204858e+06 | 4688612.0 | NaN | NaN |

| 1 | 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | -0.000788 | ... | NaN | NaN | NaN | NaN | NaN | NaN | 5.290623e+06 | 8994200.0 | NaN | NaN |

| 2 | 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | -0.006397 | ... | NaN | NaN | NaN | NaN | NaN | NaN | -4.328196e+07 | 337377600.0 | NaN | NaN |

| 3 | 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | -0.062705 | ... | NaN | NaN | NaN | NaN | NaN | NaN | 3.273491e+06 | 5601300.0 | NaN | NaN |

| 4 | 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | -0.013411 | ... | NaN | NaN | NaN | NaN | NaN | NaN | 9.599290e+05 | 4415600.0 | NaN | NaN |

5 rows × 23 columns

# remove irrelevant columns

df = df.drop('index', axis=1)

#df = df.drop('level_0', axis=1)

df.head()| Date | Ticker | Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | ... | macd signal | bb_low | bb_mid | bb_high | sma | ema | ad | obv | emv | efi | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2014-04-29 | A | 35.049534 | 38.125893 | 38.304722 | 37.174534 | 38.118740 | 4688612.0 | -0.002274 | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | 3.204858e+06 | 4688612.0 | NaN | NaN |

| 1 | 2014-04-29 | AAL | 33.476742 | 35.509998 | 35.650002 | 34.970001 | 35.200001 | 8994200.0 | -0.000788 | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | 5.290623e+06 | 8994200.0 | NaN | NaN |

| 2 | 2014-04-29 | AAPL | 18.633333 | 21.154642 | 21.285000 | 21.053928 | 21.205000 | 337377600.0 | -0.006397 | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | -4.328196e+07 | 337377600.0 | NaN | NaN |

| 3 | 2014-04-29 | ABBV | 34.034985 | 51.369999 | 51.529999 | 50.759998 | 50.939999 | 5601300.0 | -0.062705 | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | 3.273491e+06 | 5601300.0 | NaN | NaN |

| 4 | 2014-04-29 | ABT | 31.831518 | 38.540001 | 38.720001 | 38.259998 | 38.369999 | 4415600.0 | -0.013411 | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | 9.599290e+05 | 4415600.0 | NaN | NaN |

5 rows × 22 columns

import pandas_ta

df = df.set_index(['Date','Ticker'])

# compute FI

def compute_efi(stock_data):

efi = pandas_ta.efi(close=stock_data['Close'],

volume=stock_data['Volume'],

length=13)

return efi

df['efi'] = df.groupby(level=1, group_keys=False).apply(compute_efi)

df.tail()| Adj Close | Close | High | Low | Open | Volume | garmin_klass_vol | rsi | atr | macd | macd signal | bb_low | bb_mid | bb_high | sma | ema | ad | obv | emv | efi | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | Ticker | ||||||||||||||||||||

| 2024-04-25 | XYL | 130.610001 | 130.610001 | 131.199997 | 128.100006 | 129.619995 | 963600.0 | 0.000264 | 61.482745 | 0.665306 | 0.355146 | 0.255276 | 4.845591 | 4.863502 | 4.881413 | 128.482000 | 128.582695 | 1.381747e+08 | 42359600.0 | -1.275613 | 3.009081e+05 |

| YUM | 141.559998 | 141.559998 | 142.169998 | 140.389999 | 141.979996 | 1693100.0 | 0.000076 | 65.668163 | 0.322566 | 0.550830 | 0.285784 | 4.913482 | 4.937968 | 4.962454 | 138.497000 | 138.658563 | 8.902989e+07 | 253995207.0 | 47.014878 | 7.056074e+05 | |

| ZBH | 119.750000 | 119.750000 | 121.349998 | 118.769997 | 120.709999 | 1078800.0 | 0.000206 | 35.636078 | -0.350196 | -0.889200 | -0.646480 | 4.772846 | 4.835888 | 4.898931 | 125.012999 | 123.565569 | 7.870077e+07 | -62096220.0 | -114.852947 | -5.940560e+05 | |

| ZBRA | 292.529999 | 292.529999 | 293.290009 | 271.630005 | 274.359985 | 674700.0 | 0.001355 | 56.172272 | 0.500501 | -0.391439 | -0.242456 | 5.588730 | 5.666387 | 5.744044 | 288.205502 | 284.262362 | 5.349014e+07 | 37474700.0 | -2359.322092 | 1.337205e+06 | |

| ZTS | 153.360001 | 153.360001 | 153.589996 | 150.039993 | 150.970001 | 4567200.0 | 0.000178 | 39.809619 | 1.374957 | -3.202379 | -3.584353 | 4.967408 | 5.065065 | 5.162723 | 157.579352 | 157.003521 | 2.636284e+08 | 255609600.0 | -95.499616 | -4.281032e+06 |

# update the database

df = df.reset_index()

df.to_sql(name="SP500",

con=sp500_db,

if_exists="replace",

index=True)

sp500_db.close()import matplotlib.pyplot as plt

from datetime import datetime

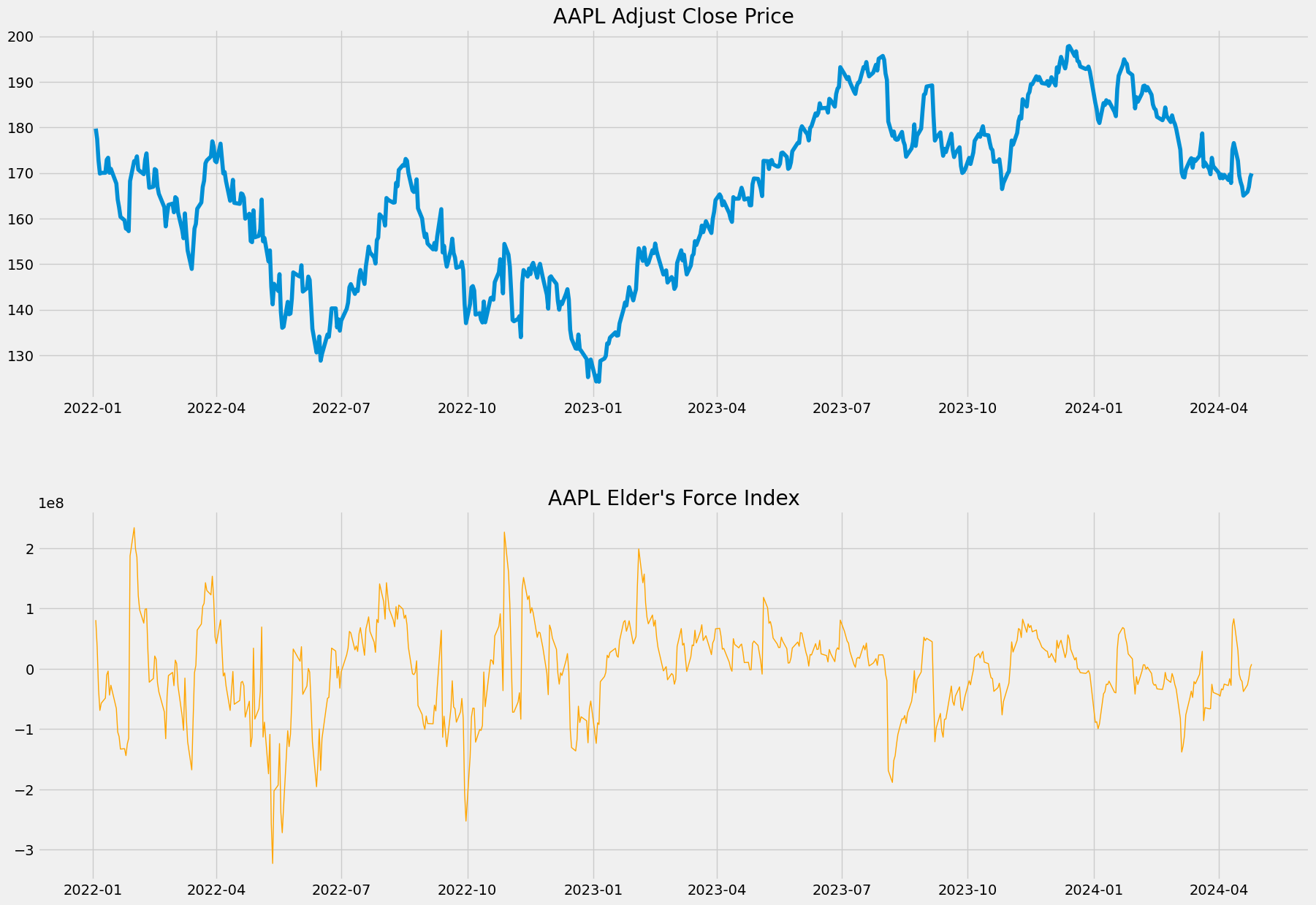

# select AAPL

aapl = df[df['Ticker'] == 'AAPL'].set_index('Date')

# only select the data from 2022-01-01

aapl_new = aapl[aapl.index > datetime(2022,1,1)]

# set the theme of the chart

plt.style.use('fivethirtyeight')

plt.rcParams['figure.figsize'] = (20,16)

# create two charts on the same figure

ax1 = plt.subplot2grid((10,1),(0,0), rowspan=4, colspan=1)

ax2 = plt.subplot2grid((10,1),(5,0), rowspan=4, colspan=1)

# plot the closing price on the first chart

ax1.plot(aapl_new['Adj Close'])

ax1.set_title('AAPL Adjust Close Price')

# plot the EFI on the second chart

ax2.plot(aapl_new['efi'], color='orange', linewidth=1)

ax2.set_title("AAPL Elder's Force Index")Text(0.5, 1.0, "AAPL Elder's Force Index")

Reference

Force Index: Overview, Formulas, Limitations by Cory Mitchell on Investopedia